Anyone buying or selling a home should understand the role an “RPR” can play in the transaction.

Many times one may need to know how “Title Insurance” differs.

To clearly understand the implications of the “RPR’s details / Title Insurance” one must consider the individual property, details of the transaction, details of the RPR, all relevant information available, and how it all works together to determine the impact / mitigation of various aspects of risk / reward and therefore: value.

For example: A Current RPR can add value and security in many (most…) cases (dependent on the details)

A Current RPR with Compliance could add more value…

In cases where no RPR exists or there is NON – Compliance, the correct steps may VARY GREATLY depending on the specifics of the transaction.

Doing it right is critical to avoid liability & many potential unknowns. Title insurance may be a viable/best option in the interests of all parties.

Providing support and guidance on the subject is just one example how I help as your REALTOR®: A dedicated, accountable consultant & resource who works to help assure YOUR BEST INTERESTS when you are my Client.

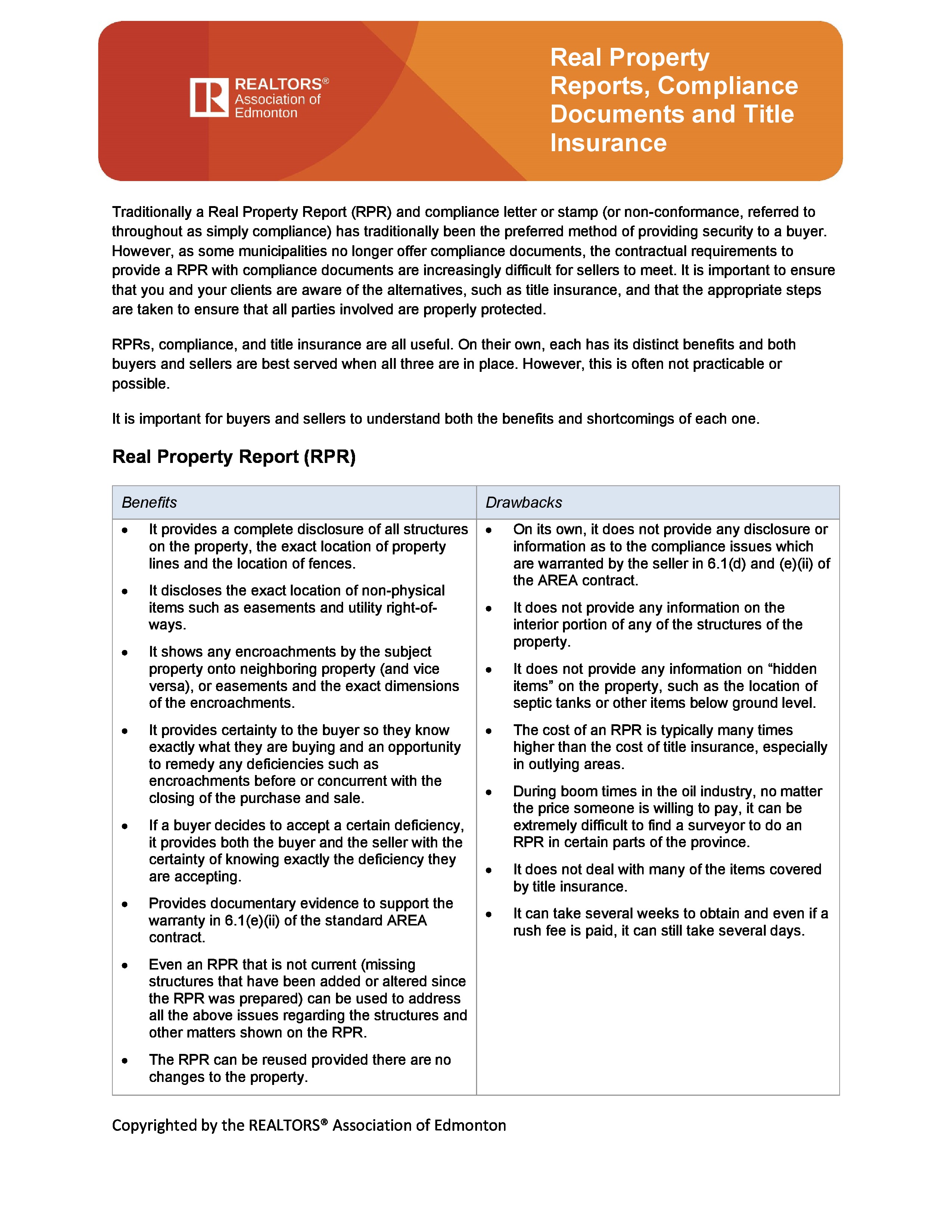

Want to scratch the surface? Give me a call anytime / check out the enclosed is a great article from the REALTORS® Association of Edmonton (RAE) detailing the differences between RPR’s and Title Insurance:

RPR-Compliance-Title Insurance RAE Facts